Usury is the practice of lending money and expecting more in return. Usury has the unfortunate by-product of creating unpayable debt. With the unpayable debt, it creates extortion, misery, and financial enslavement. The Church, believing that they had interpreted the prophets correctly, had created the laws of ‘Usury Prohibition’. These prohibition laws stood for around 1500 years, but not without problem. Here is a wise insight by a few real thinkers, of whom we have few with ‘modern’ education. And of those ‘real thinkers’, many are engaged in ways of subjugating us.

To explain Usury, I usually tell a story:

“If you and I own all the gold in the world and you and I lend out that gold and expect ten percent more at the end of the year, we have created a conundrum. After one year, the people must pay us gold plus ten percent. After two years, they owe us gold plus ten plus ten. It is impossible to repay the debts. You and I start to own all the assets in society. Then we start to dictate control over the people. When we say ‘kill each other’, they kill each other. The populace is as putty in our hands.”

Andy Chalkley

This lending of money is called “Usury”. It tends to create impoverishment and misery. It allows usurers to control all aspects of society.

‘Usury Prohibition’ is now voiced as the quaint restrictive ways of the old days. The modern ‘money lender’ is portrayed as the one that brings the gift of money, progress, and happiness to society. The ‘Usurer’ (Money Lender) is portrayed by the usurer’s propaganda arm as the benefactor of society. Yet most struggle with debt that drains them of every spare dollar. They think they are luck that they have a credit card to keep them fed. The ‘maxed-out’ credit card is usury central.

It is important to recognize that: Usury Prohibition failed. It failed, not because of the usurers, but because neither the Worldly Leaders, nor the Church organized an alternative which would be the institution of interest-free lending. Neither would the rich lend without interest. The rich would become ‘usurers’. Only family lends without interest and without bondage and without full expectation of repayment.

As a result, there was a scarcity of credit. Even Mohamed recognized that society needed credit. He made strict rules on ‘Riba’, the Muslim word for Usury. Credit is a necessity in any economy. Mohamed was a buiness man and he recognosed that businesses needed money before they can make money. Businesses need credit, or nothing gets done in society. If credit dies, business die. It is the extension of credit for business needs that causes economic activity.

Learned people like Calvin and Bacon documented the evils of Usury. But they failed to point out the need for credit as a life-blood for business. They only got half the formula. The lending of money in the form of credit whilst expecting more in return is Usury, but the landing of money where only the principal is repaid is not Usury. This is ‘interest-free’ credit. This failure left the door open for the end of prohibition which led to the rise of Banking and Capitalism.

Money is but a human invention. It is one of man’s greatest of inventions. Money can be created in any quantity at no cost. So we say that Money has ‘no intrinsic value. It is not the paper that is valuable, it is the transactions that occur when it changes hands that are value adding to society. Money must move to be useful. Each time a ten dollar note changes hands, ten dollars of useful activity occurs, all by a piece of paper that cost nothing to produce. Such is the miracle of money. Notes can be pumped out of a machine in great quantities. Credit can be created by the insertion of a line of ink in a book. Money is a freely created commodity. But it is not free to the populous nor aspiring business operators. China moved forward at a great pace during my lifetime due to the provision of credit. It set up a ‘Public Bank’ system. This ensured that credit was available at every level of business to encourage entrepreneurial activity from the rice grower to the factory owner. You can borrow money if you are going to do something useful with it. If you want to play financial games, you get no money. China’s development of its Public Banking System follows the Public Bank system created in 1911 in Australia that was overturned by agents of the City of London. Usurers do not like Public Banks! Usurers do not like issuers of ‘interest-free credit. This Chinese Public Bank System is similar to the Public Bank system set up by the Germans before it was crushed by WW2. The Usurers (Money Lenders) certainly do not like ‘Public Banks’. If history dictates, either China will be taken down by world war, or the Usurers will transplant themselves to China as their cash-cow and let the West stagnate and self implode. The degrading demise of the West will be blamed on decadence and degeneracy, both of which were ushered in by the very same Usurers.

So the key issue that caused the reintroduction of Usury is that ‘Prohibition of Usury is not enough.’ It is Usury that has caused the current unsustainable debt levels experienced by governments, nations, and citizens. There must be a provision of ‘interest-free’ credit to the State, businesses, and citizens. Mohamed got reasonably close by banning the Usury for consumption whilst allowing the lending of money for productive business purposes.

One of the arguments for Usury and Capitalism is that it leads to ‘economic growth’. The reality is that 250 years of ‘growth’ has created Plutocrats of great wealth and influence and a vast sea of citizens that work full time and own zero assets or have a net worth less than zero. Even in my lifetime I have seen a change. The house I live in was constructed in 1940. the land was provided by god or nature for all living things to share. Thus the land is effectively ‘free’. The building was erected in about ten weeks by a group of ten men. The house was designed for a young family and the repayments could be easily managed by a working husband working five days a week whilst supporting a wife and small child. Why then does it take a young couple half a life time to repay debt on a house that was built and paid for eighty years ago?

Under Usury, debt grows eternally. All the increase in our wealth is taken by the very richest. As the economy grows, their assets and dominance grows further and the poor become dependent on their largess.

People now work longer, harder hours than people did five hundred years ago. Much of their production is leached off with unearned income for capital and the state, leaving the citizens with little more than debt repayments. So many citizens have negative net worth. Total production may be high, but it is at the expense of the citizenry with damaging consequences for natural resources.

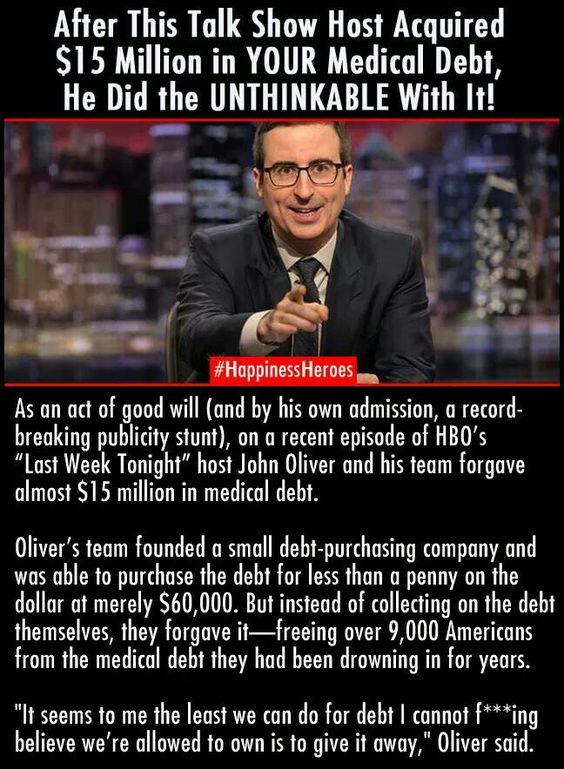

The new economic lesson from history is that Usury is not solved by Prohibition, but by the provision of interest-free credit. Thus the need for the likes of ‘The Institute for Public Banking’. By this means we can end Plutocracy, make Usurers superfluous and meet the needs of people and their daily business.

(Adapted from a comment by ‘Real Currencies’ with great thanks.)

For the economically literate persons among you, the article in of interest is:

“Evading the‘Taint of Usury’: The usury prohibition as a barrier to entry” by Mark Koyama, Department of Economics and Related Studies, University of York.

https://mason.gmu.edu/~mkoyama2/About_files/Koyama10b.pdf

Perhaps the most progressive group on ‘interest-free’ credit, or the closest thing to it, is the ‘Public Banking Institute’.

Get on their email list or give them every help you can.