Author: Andy Chalkley

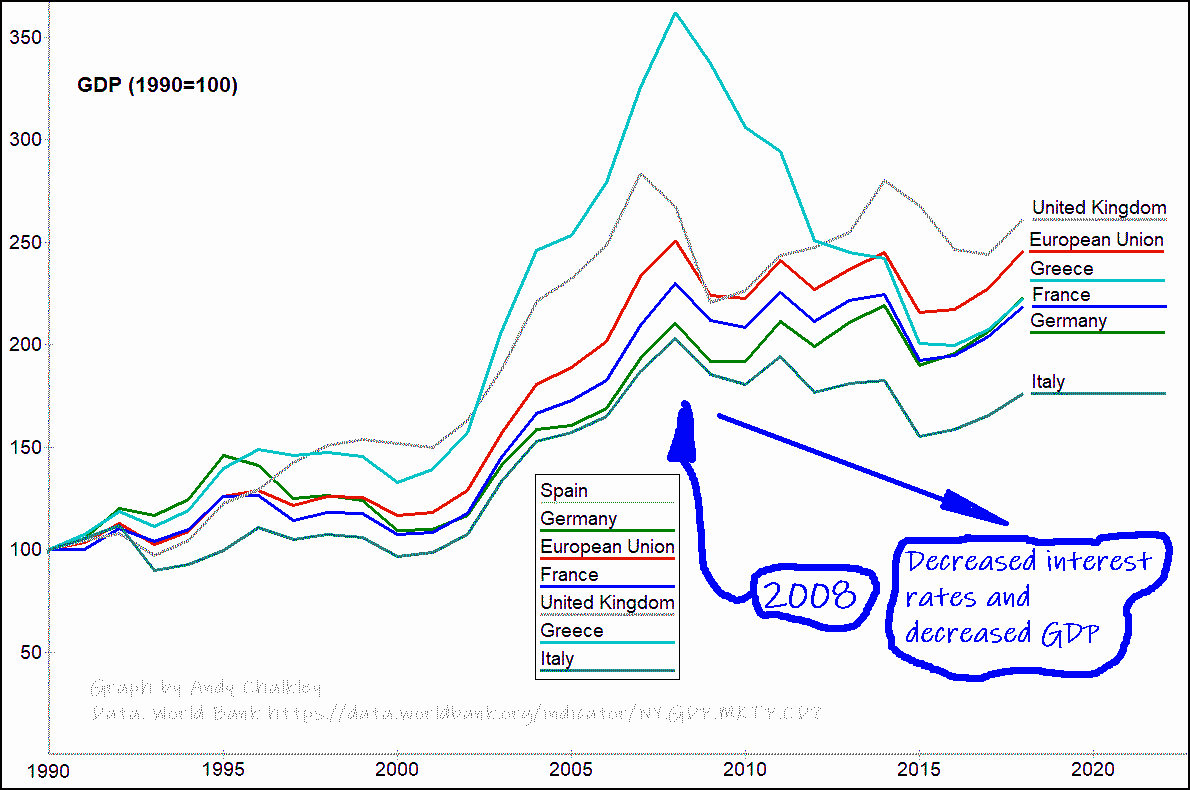

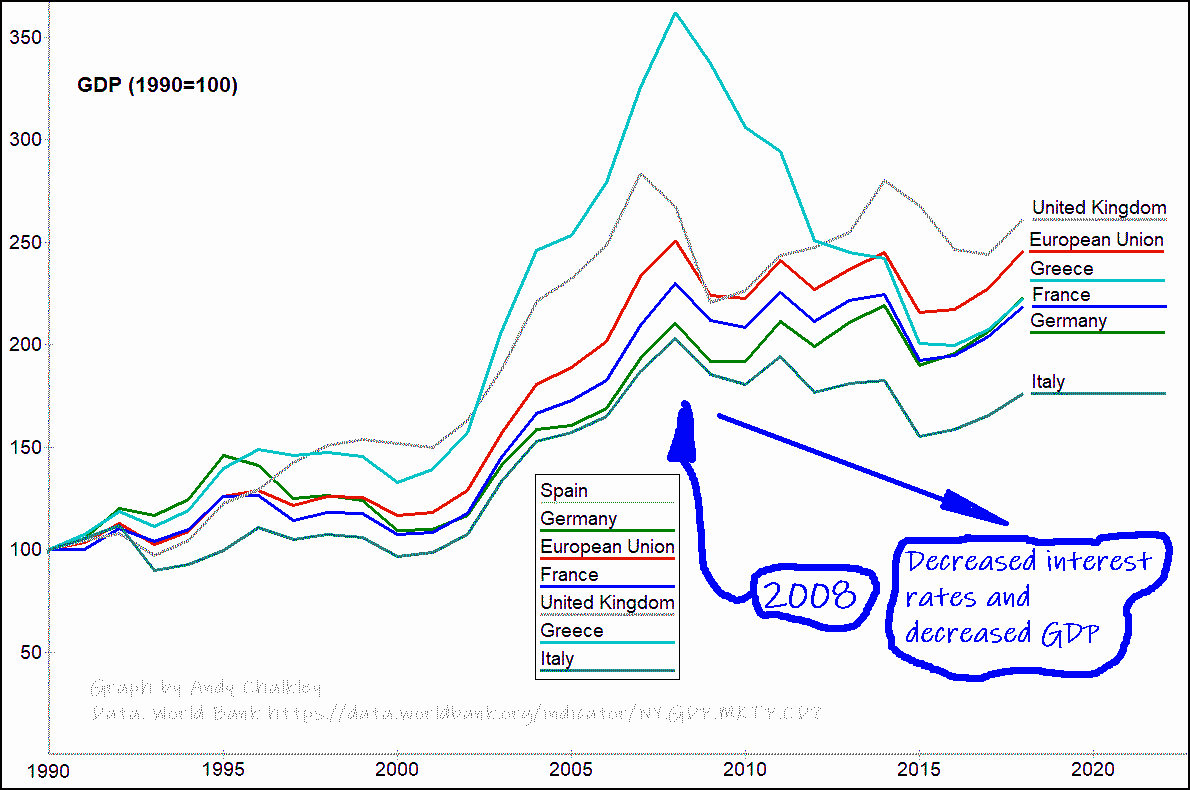

Europe lowered its interest rates from 5% to 4% to 3% to 2% to 1% and it did not improve the economy. They succeeded in proving that it was failed policy. Lowering the rate to 0% and below will not improve ‘Economic Activity’. They followed a path that favours the banking industry. Raising interest rates tends to decrease Economic Activity. The decrease is often far in excess of the percentage change for reasons I will explain. But the opposite does not do the opposite! Lowering interest rates does not do the opposite of raising the interest rates. It will not revive dead businesses and burnt out businessmen. It will not increase spending when there is no money to spend. Efforts have to be made to resuscitate business. Lowering and raising are not complementary. Yet, there is another method that will increase Economic Activity, but this obvious method been being ignored. The poison did not kill the cat. Give the cat more poison! Here is the GDP for some European nations. For ten years, they have failed.

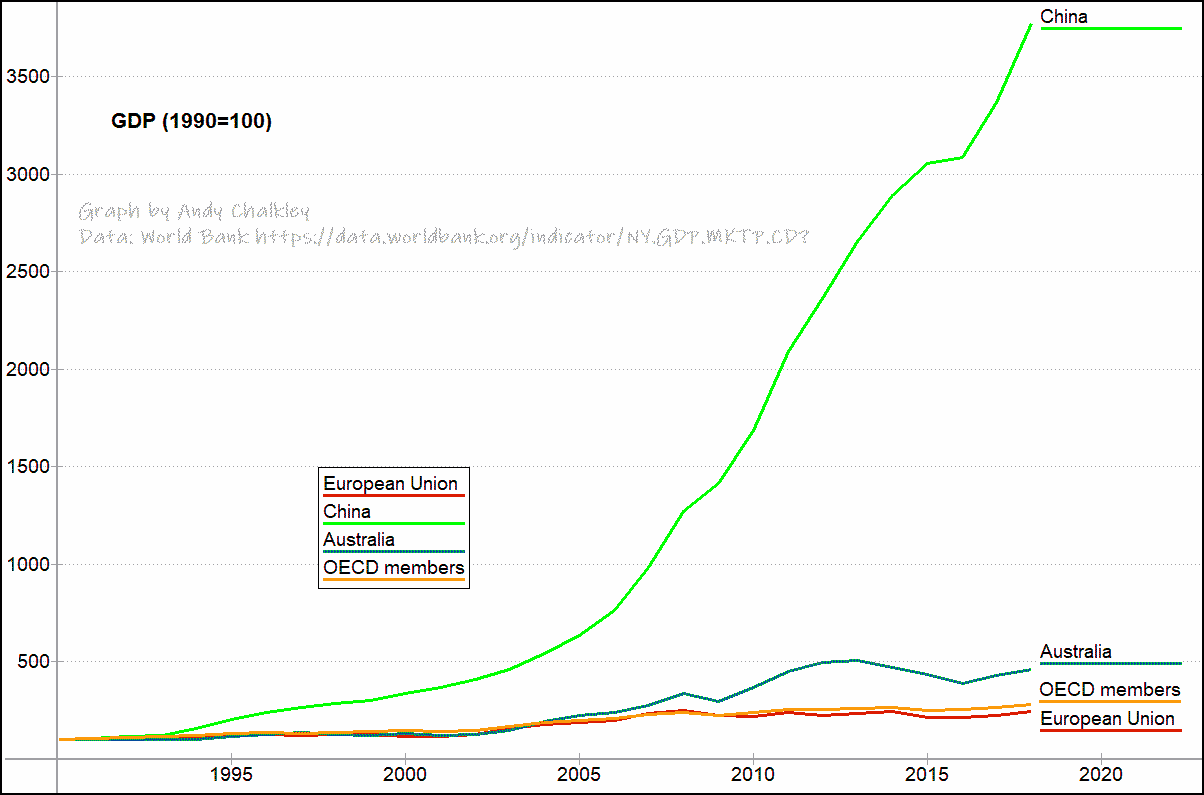

Let us not look in isolation. Here is Europe with some other nations that did not go negative and will not be going negative:

Any businessman would know that his turnover for the year depends on the magnitude of his stock and the number of times that he turns it over. Similarly for a nation. The turnover of a nation (GDP) is the volume of money in the society and the number of times it changes hands in a year. If a small nation has a Money Supply of $6 billion, if it turns it over ten times, it has a GDP of 60 billion. If it turns it over five times it has a GDP of 30 billion. You could throw more money into the nation or make the money move more often. The economists write this as:

GDP = MxV

Where GDP is the Gross National Product which is ‘Economic Activity’ for one year. M is the Money Supply which is the volume of money available in the nation and V is called Velocity which is the number of times that money changes hands in a year. The smart will spot that GDP can be increased by increasing the Money Supply. The very smart will spot that the GDP can be increased by increasing the velocity. But the equation obeys the rules of mathematics. The unwanted occurs. Increasing the Money Supply tends to decrease the Velocity causing no increase in Economic Activity. GDP = MxV Increase M and either GDP increases or V falls — that is mathematics. A fall is different to an increase. You can pull a donkey with a piece of string but you cannot push. If you kill the parrot, you cannot un-kill the parrot! Virginity lost — is virginity lost. If you destroy the production in a nation by bankrupting business, throwing money at the problem does not magically re-open failed and demoralized businesses. For too long, we have listened to cultured voices espousing confidence in the illogic of interest rate control as the sole and primary plank of a ‘Monetary Policy’. Their beliefs play directly to the benefit of the private moneylenders. Moses recognized that money-lending was a war tactic against the people. 1500 years later, Jesus threw them out of the temple. Six hundred years later again Mohamed made strict rules controlling their lending habits. Around three hundred years ago, the money-lenders gained ascendancy and led us into the modern era of unpayable debt, control of politics, control of media, and war. They love getting people and nations into a ‘debt bind’. They want us to borrow more rather than use existing money more efficiently. The become powerful when there is ‘more debt than money’. World-wide, there is twice as much debt as there is money.

the money-men’s ‘Negative Interest Rates’ will take us into uncharted territory with unknown consequences. But there is a simpler solution. We can easily bolster the economy by tickling the Velocity. We need to make money move. Not more money but more money movement. Australia has a Money Supply of about $A2000 billion. If we turn that over one time in a year we have a GDP of $2000 billion. If we turn it over two times, we have a GDP of $A4000 billion. Currently, we fail to turn it over even once in a year, so we have a GDP of $A1890 billion. Money sits idle in bank accounts for month after month after month.

We owe it to ourselves to become economically literate. Until we do so, the clever-clowns will retain their control even in the light of glaring incompetence. We can call their bluff on their thinking that the economy is adjusted by adjusting the Volume of Money. You are now an enlightened thinker who realizes that ‘Economic Activity’ equals the ‘Volume of Money’ and the number of times it changes hands. If a ten dollar note changes hands twenty times, then two hundred dollars of Economic Activity occurs. If our ten dollar note changes hands forty times, then we have four hundred dollars of Economic Activity. Economists commandeer this logic as GDP = Money Supply x Velocity, where velocity is the number of times the money changes hands in one year. Mathematicians will write it as GDP=MV. But an economist blindly assumes that the way to increase the Economic Activity is to increase the Money Supply. An increase in velocity will have the same effect. High velocity is a sign of a buoyant economy. Low velocity is an indicator of a sluggish economy. We shall shout from the rooftops: “Keep that money moving”. If I give you ten dollars, I get my hair cut. You get your nails painted. The nail artist gets a bag of apples. The grocer gets more eggs. The farmer gets red paint for his tractor. The paint shop gets his hair cut and so forth. Yet, the ten dollar note cost nothing to create. It came flying out of a print machine at no cost. Money costs nothing to create. Money has no ‘intrinsic’ value. Its value lies in its ability to create economic transactions and the more transactions it creates, the more apples we eat and the more haircuts we receive. The essential component of a healthy economy is that freely created ten dollar notes change hands frequently. In the limit, if money does not move, we have no economy.

At the end of the Second World War, there was an interesting photograph taken of Roosevelt, Churchill, and Stalin that gives the impression that they alone determined the future of Europe and the world. Besides borders and hegemony over nations, decisions were made by bankers about money systems and monetary control. This is why politicians parrot: “Keep the central bank free from political interference.” This conveniently leaves the central banks, nominally owned by the government, to be controlled by the moneylenders. The central bank controllers go off to their regular instructions at a centralized location called: “The Bank for International Settlements”. This BIS is a private corporation controlled by the ‘Men of Money’ — not by democracy. It carries out its business in secret meetings which determine the well-being of national economies along with expansion of Money Supplies through lending or the contraction of national Money Supplies by restriction. They expand by lending and contract by refusal to lend. They are often on the side of evil when they ‘call in’ loans to farmers with the fascinating side effect of bankrupting farmers. Their grandiose institution entirely ignores Velocity to the benefit of their private lending institutions. These central banks are stacked with persons from the private banking industry.

The BIS and its network of Central Banks exercises a privileged monopoly of the issuance of money which it creates by ledger entries as it creates debt. It does not create the extra money to repay the interest, and lives off perpetual national debts that consume the future income of nations and its peoples. Under international law, it cannot be repudiated even by an internal political revolution. This group of banking interests demands special privileges and sometimes military intervention to collect these debts from nations. It has the privilege of a supply of untaxed income enforced by liens on public and personal property and collected by the collective force of the tax structure of the various nations.

By World War One, most nations had tolerated the monopoly on the issuance of bank notes. By discouraging the formation of government owned banks called “Public Banks”, the moneylenders also have a full monopoly over the issuance of credit. Nothing gets the wars cranking faster than a nation escaping their control of the money creation.

The bankers prefer to follow the doctrines that are encapsulated in the ‘Quantity Theory of Money’. The Quantity Theory of Money emphasizes that the Money Supply is the main determinant of nominal gross domestic product. The ‘Quantity Theory of Money’ makes a fascinating assumption that the velocity of money, V, is constant. If V were constant, increase in economic activity should occur when there is an increase in the Money Supply. However, velocity continues to fall as more money becomes hoarded. This means that the portion of the Money Supply that actually moves on a day to day process is shrinking. We are led to believe that our money institutions are acting in our interest and that they keep us in a sound financial position. Our news tells us so. The reality is somewhat different. They are wrong on both accounts. Economic activity is equally dependent on Velocity. Money Supply is not the sole determinant.

The world money system froze in 2008. One ‘Investment Bank’ collapsed and other banks did not know who was capable of paying who, such was the complexity of ‘who owes money to whom’. There is a need to protect our money system from collapse.

In Australia, the young can no longer afford houses. If the young cannot afford houses, we have fake affluence.

Here is a graph of velocity to show world trends under the ‘moneylender’s hegemony’:

The central banks in many cases are owned by the government, but like the car that I bought for my daughter, over which I have no control, the government is required to ‘butt out’ of issues monetary. From the above graphs you can see that velocities are hitting the unfathomable lows of one. This means that the majority of the money in the world only changes hands once in a year. The average ten dollars enacts one ten-dollar-transaction in a year. But, in our haircut example, we can envisage a ten dollar note enacting twenty transactions in a day which would equate to 7 300 transactions a year which equates to $73 000 of economic activity in a year. So much money sits idle in the bank accounts of the well-off. Let us be more practical. The street beggar who gets ten dollars spends it immediately. The beggar has a velocity of 365. The wage earner spends all his money by the end of the week. The wage earner has a velocity of 52. The well off have squillions stored in bank accounts which sit there for year after year. They are the culprits creating our dead-money velocity of one. It is trickle-down economics because it is just that. Money only ‘trickles’ out of their bank accounts. The solution is to make money move.

This next graph shows the Money Supply and associated debt for Europe. The orange part is the cash currency issued by the ECB (European Central Bank). The Green section is the vacuous ‘credit’ issued by the money lenders acting as banks. The red is the combined government debt along with the private debt (mortgages, car loans and other loans) owed to the moneylenders.

The debt is scary enough, but if we refuse to pay it back, we can survive the onslaught of the biblical usurers that the prophets of all religions warn about. The significant problem for Europe is the green line for M3 from about 2008. It has failed to rise at an acceptable level for a healthy economy. The graph of ‘Economic Activity’ (GDP), below, illustrates the problem that deceased interest rates failed to resuscitate since about 2008:

I shall illustrate with figures for Australia because they are typical and I have the figures to hand from a submission to the Australian ‘Banking Royal Commission’. In Australia, currency component of the Money Supply is $74 billion. This means that the Reserve Bank of Australia has created $74 billion in cash folding notes. [1] At population of 24.6 million, there is $3000A in cash folding notes per person in supposed circulation. I own my house and am quite well off but I don’t have $3000A in my wallet. $3000A is plenty Money Supply for any person. However, the total Money Supply in Australia is listed as $2091 billion. This is $85 000A per person. Any thinking that $85 000 of money for each person in Australia is an inadequate volume of money is inadequate thinking. The problem is not inadequate Money Supply, but inadequate movement. I remain answerable to the Queen. The ‘Quantity Theory of Money’ is no theory at all. Jesus threw the moneylenders out of the temple for good reason. A ‘Theory of Money based on Velocity ‘ would better serve us. Why drag more borrowed money into a system that is already overloaded at $85 000A per person? The problem is that my $85 000A fails to move. In Australia, people joke that something is slower than watching the grass grow. My lawn needs mowing twelve times before the $85 000A moves. A boring topic is described as: “like watching paint dry”. Some objects would require repainting before the money moved. A snail can reproduce twelve times in one year. The velocity of one allows a snail to outclass our failing money system where we tolerate money held idle in bank accounts. We need to move at a ‘snail’s pace and move our money twelve times in a year.

How do we make money move?

We must make money move by any means. (with some caveats!) There are at least four prongs to this fork. The simplest prong is the bank accounts. Money must not sit idle in bank accounts. I make an executive decision that any money left in a bank account for longer than one month to be deemed as ‘hoarded’. It should thus attract a mild tax. My elsewhere calculations [link] suggest a tax of somewhere up to 1% per month on minimum monthly balance. We re-jig the tax system so that money that moves is not taxed whist idle money is taxed. ‘Idle Money Tax’ is effectively a tax of the order of 10% — which is of the same order as the commoner’s interest rate. The second prong is to correct the errors in the tax system. Money that moves is doing the heavy lifting of the economy. Unfortunately, we have biased our tax system to tax money when it moves. Sales Tax is a major culprit as is Income Tax. Sales Taxes directly tax money when it moves but ignores money that is idle. Similarly for Income Tax. Sales Tax and its variants should be all but eliminated except for products and services that are damaging to health or environment. Income Tax should be all but eliminated for in favour of Wealth Tax and Death Tax. Better you take my money when I die than stifle me whilst I live. There should also be a mild Transaction Tax of around 0.1%. This is one dollar in a thousand – a nothingness compared to an Income Tax in excess of $330 per $1000. 0.1% is $1 in $1000. This would bring the transactions of the affluent, who slosh their money around on investments, into the taxation mix. I shall give you my story of gold paint.

If I buy gold paint to paint my office, I pay Sales Tax. If I buy a block of gold, I pay no tax. If I buy shares in a gold mine, I pay no tax.

There is little logic in this exclusion that benefit of the well off. I shall pay $1 in $1000 on my gold paint instead of $100 in $1000 and the well-off shall pay $1 in $1000 instead of nothing. The scary part is that velocity may rise too quickly. So some restraint will be required as velocity rises to the occasion and regains its former glorious heights. The third prong is to ensure that prospective businesses at all levels have access to cheap credit. The hidden secret here is to create a government owned ‘Public Bank’ that supports business enterprise at all levels. It was the secret of Australian economy from 1911 when Australian people became the most prosperous persons in the world until its newly created ‘Commonwealth Bank’ was stifled at the insistence of a visiting ‘City of London’ agent sending Australia into the ‘Great Depression’. The secret of China’s rise to economic prominence is tightly tied to its creation of a network of Government owned ‘Public Banks’ creating credit for enterprise at all levels. Business requires cheap credit to thrive. The government may make little out of the lending exercise but it wins significantly when the economy takes off. My fourth prong is to make money move by making businesses do business. If the citizenry wish to have haircuts, it is necessary to make it easy for hairdressers to obtain employees with minimal hassle. Nobody sacks good employees. Just as a business owner knows that if good service is not given, the work will dry up. Employees need to be clear that if they do not give good service, a ‘good bye’ letter will shortly arrive. When I say to persons: “If you won a million dollars, would you buy a factory and employ people?” The common answer is: “No way. Too much hassle.” The workers recognize the problem but the law does not. Regulatory red tape reduction is commonly proffered but rarely occurs. The depreciation rules ensure that expanding business run short of money such that they need to run to the moneylenders. It is ridiculous because government collects more tax from thriving businesses.

Moses warned us about money manipulation but authorized it as a method of subjugation. Jesus threw the moneylenders out of the temple. Mohamed was a trader and recognized that businesses needed money before they could make money. He made strict rules on the lending of money and expecting more in return. The Church banned usury but suffered from the lack of credit and the hoarding of specie by the affluent. The Koran contains the only statement on hoarding that I have yet found it states, in my wording: “If you hoard money, when you die, it shall be heated in the fire of hell and burned onto your forehead.” Which is Koran-speak for: “Don’t hoard.” Someone recognized that to hoard portions of the circulating medium causes stagnation. In mathematics jargon, in the limit, as all money becomes hoarded in the bank accounts of the well off, there will be no economic activity. It is ridiculous to create $85000A of combined currency notes and bank wishful thinking, to have it sitting idle. Money does nothing for the economy when it sits idle. Currently, the government only collects tax on money when it moves thereby stifling the very activity that generates tax. Little wonder that a little miracle occurs when the tax rate falls, tax collection may actually rise due to greater economic activity. Tax rate decrease can cause an increase in tax collection. Here is a difficult to comprehend graph and it is controversial:

This old illustration from ‘Coin’s Financial School’ of 1894, hints at the problem of the hoarding of money in a time when gold coins were in use. If the well-off hoard the coins for ‘a rainy day’, then there becomes a shortage of coins for day to day transactions. Gold does not make a good money system and rapidly becomes dominated by the well off whilst creating a horrible shortage of trading coins for the poor. A well managed paper-money ‘Fiat’ system is better for a nation because it allows steady expansion as needed and hoarding is less of a problem as it can be circumvented by a mild printing exercise. Gold is useful to kick-start a failed money system, but then needs to be gradually disengaged as it tolerates hoarding by the well off causing an almost permanent state of depression for the poor.

We need to ensure that our banking system serves the economy and not the other way around. The banking system is tolerated to making affordable loans to businesses of all sizes so that these business can employ persons so the livelihood of all is benefited.

Here is a little voice from inside the Bank of England squealing for some commonsense thinking. I back up some of my previous statements with these words that escaped from the Bank of England in a document titled: ‘Bulletin by the Bank of England (2014 Q1)’ [3]

“This article explains how the majority of money in the modern economy is created by commercial banks making loans.” [3] …

Bulletin by the Bank of England (2014 Q1)

..the majority of money in the modern economy is created by commercial banks making loans.

Bulletin by the Bank of England (2014 Q1)

“Money creation in practice differs from some popular misconceptions—banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits.” [3] …

Bulletin by the Bank of England (2014 Q1)

“In the modern economy, most money takes the form of bank deposits. How those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” [3] Bulletin by the Bank of England (2014 Q1)

“The reality of how money is created today differs from the description found in some economics textbooks:” [3] …

Bulletin by the Bank of England (2014 Q1)

“money is largely created by commercial banks making loans.” [3] Bulletin by the Bank of England (2014 Q1)

Even the Multiplier effect was quashed when the Bank of England pointed out that the banks can borrow the reserves. [3] Bulletin by the Bank of England (2014 Q1)

The central bank usurped the power to control the Money Supply and to do this it adjusts the interest rate. The banks have created so much un-payable debt that is is difficult to create more debt. In desperation, to keep their gravy train going, they are taking us into the uncharted territory of negative interest rates. However, it was not as if it was unknown that their practices were somewhat ineffective. As this little ray of logic escaped the Bank of England in 2014:

“Is it difficult to believe that the Central Bank with the blunt instrument of interest rate control can control private corporation lending habits. As inflation continues to flourish, their control appears to be a carefully controlled myth.” [5]

Notice that they say: “their control appears to be a carefully controlled myth.” It is not appropriate to allow a group of cooperating private corporations, who lend money for profit, manage the magnitude of the Money Supply. A skilled ‘Commissioner of Money’ is needed to manage its magnitude. Never forget that money is a freely created commodity. It is issued in restricted volumes to maintain its demand. Its backing is the GDP. People are happy if it buys them part of the GDP — if it buys them goods. Thus the backing for money is the GDP. (Not gold.)

Who should create the Money?

One accepts that the government has the authority to create the money of the nation. In Australia, The Reserve Bank creates $74 billion of the $2091 billion Money Supply. This is 3.5%. Even then, there is the question about ownership of the Reserve Bank versus control of the Reserve Bank for they are not the same thing. 96.5% is created as credit by private banks. 0% is created by Public Banks. China has done remarkably well in using Public Banks to bolster its economy. Australia did remarkably well with its original Public Bank, the Commonwealth Bank, set up in 1912, until it was neutered and turned into a private bank. The Commonwealth Bank financed businesses, home buyers, manufacturers, primary producers, and in the process created a vibrant and rich economy. The creation of credit and the maintenance of its volume is crucial to the economy and well being of the country. These essential features have become a private monopoly by a group of banks who judge their performance by their profits, not by the well being of the nation. They have a habit of lending when the economy is buoyant causing selective inflation in areas to which they lend and they cut back on lending in tougher times just when more credit is needed. Their history is atrocious.

For financial and economic well-being, these two related critical functions need to become a people’s monopoly. This is not new. Mr. Duthie had this to say in the Australian Parliament in a heated debate in 1947:

“…control of finance and credit can no longer remain a private monopoly, but must, for financial and economic sanity, become a people’s monopoly. Ever since 1694, private banking institutions have issued the credit of the nations and dictated to governments, withholding or releasing credit at will, thus holding in their hands the destinies of the people. For 353 years, these institutions have had world ramifications, surrounded themselves with a ‘holy of hollies’ atmosphere, discouraged a study of money and finance among the common people, put out such false stories as ‘safe as a bank’ and ‘banks lend only their depositors’ money’,…” [6]

The date 1694 is the date that a private group of businessmen created their own private bank which they inappropriately named “Bank of England”.

“Ever since 1694, the private banks have created credit on which they have charged interest to individuals and governments.” [6]

“…it can be seen what a profitable industry the private banks have carried on for 353 years—creating credit by book entries in a ledger and charging the borrower up to 10 per cent., and even 12 per cent., interest. Credit manufacture became more profitable when it was discovered that a bank could lend safely even up to ten times the amount of its deposits. Money has been made a weapon for good or evil, boom or slump, in the hands of private banking institutions—a master of the people and governments instead of a servant.” [6]

It is a serious question whether an un-elected group of private interests should have total control over the means of exchange and its volume. It is in the hands of these people to irresponsibly or maliciously restrict the availability of credit which dramatically alters the economic activity of the nation. The volume of credit needs to be adequate in magnitude and to mildly increase annually in line with available economic output. It is not clear whether one drives the other or the other drives the one. But the magnitude and gradual increase are critical to the health of the nation. At times of restricted lending, there arrives a calling in overdrafts whilst reckless lending occurs in better times. The banks are in the privileged position of creating ruin.

It is to be considered whether the private manufacture of credit, our crucial medium of exchange, should be in private hands. It is as if they have been given free rein to counterfeit.

Mr. Duthie’s 1947 comments are still relevant today. Why do we tolerate a private banking industry providing 96.5% or the money in use in our nation? They fluctuate its volume and decide who is allowed to obtain credit. By drying up credit to small business, we are pushed into the hands of corporations. The amusing concept that a Central Bank, nominally owned by the government but stacked with bankers, can alter the volume of credit issued by banks by adjusting interest rates is false. Mr. Duthie, whose words live on in Hansard, comments:

“The real rulers of Australia were, not the Scullin Government, but the financiers outside Parliament, who were subject to no one but their shareholders, who demanded that, where the people’s welfare and their profits clashed, the profits must come first.” [6]

Nowadays, they simply supply the politicians with ‘free advice’ and generous campaign funds. Mr. Duthie tells us that the same banks restrict credit to cause a recession which then gets blamed on the government.

“The banks do not like being reminded of their financial dictatorship, but we will not let them forget it.”

Mr. Riordan: talking about the activities of the private banks in 1893:

“…The failure of the banking system at that time unquestionably arrested the steady progress of the country and we had painfully to rebuild from the wreckage for which the private banks were responsible. Thousands of depositors were ruined. They had no security whatever. …” [6]

Their arguments lead to equally valid arguments of today where the government should create all the money and credit of the nation. I often ask the question: “Who has the authority to create the money of the nation?” The answer is clearly the Government. I then ask: “Why then, would the government be in debt?” The reason is that it is borrowing money from private entities by the method of issuing bonds. (Treasuries) The government should control the issue of money and credit whilst also operating a public bank. Mr. Riordan proffers the following reasons that are still valid today: [6]

- It will end the dictatorial power of the private banking monopoly.

- It will enable the people of the country to be saved from the misery and degradation of another depression by permitting the expansion of credit to offset unemployment.

- The whole of the profits from the banking system will go back to the people.

- It will protect thousands of workers who are paying off the cost of their new homes. They will not lose them as other workers did in the depression of 1929.

- It will control the issues of credit on a national scale and will ease the terms of credits for farmers, business men, shopkeepers and home-builders.

- It will permit national development to proceed with such measures as water conservation and the elimination of soil erosion.

- It will save governments from the dictatorship of private banking monopolists, who have previously forced wage, pension and salary reductions upon the people.

- It will give security to depositors, because the full resources of the Commonwealth will be behind the banking system.

- It will increase bank services to farmers.

- It will give unrestricted security to bank employees.

- It will prevent the establishment of a private banking monopoly, which is threatening Australia, as evidenced by recent amalgamations of private trading banks.

Mr Chifley, the then Prime Minister and Treasurer, made it entirely clear when he said:

“No single factor can do more to influence the welfare and progress of a community than the management of the volume and flow of money.” …

Please notice that before modern economics, Mr Ben Chifley refers to both the ‘Money Supply’ and the ‘Velocity’ using the terms ‘volume’ and ‘flow’. He demonstrates that money must exist and that it must move (flow).

“When the depression came the banks as a whole restricted new lending and called in advances.”

“In the absence of control, private banks can expand or contract the volume of their lending and so vary within wide limits the supply of money available to the public. They can also determine when and where they will lend and upon what terms; and in these operations they are guided primarily by the interests of those who own and control them. — Whatever regard they may claim to pay to the wider concerns of the nation, their policies are dictated in the last resort by the desire to make profits and to secure the value of their own assets.”

I next give you a passage from a letter from the then chairman of the Commonwealth Bank Board, Sir Robert Gibson, to the then Treasurer, Mr. Theodore, in 1931:

“Subject to adequate and equitable reductions in all wages, salaries, and allowances, pensions, social benefits of all kinds, interest and other factors which affect the cost of living, the Commonwealth Bank Board will actively co-operate with the trading banks and the governments of Australia in sustaining industry and restoring employment.”

Thus, during this critical time, the bank dictated policy to a government and at the same time knew that it could repair the damage to the economy. One can assume that it also knew that its actions caused the problems in the first place. The action of cutting credit destroys the economy. You will likely see a fall in the Money Supply as a punishment on the Australian public for daring to have a Royal Commission into its activities.

In short, the necessary procedures include:

- Economics must recognize that Velocity is as important as Money Supply in influencing Economic Activity.

- Management of the Money Supply and advice on Velocity should be in the hands of a ‘Money Commissioner’ that is independent of the entities that it controls.

- Make the money move by any means.

- Discourage the hoarding of money by placing a tax on money that is not spent with in one month. This would be a tax on minimum monthly balance of the order of no more than 1% per month. (Bank interest can be of the order of 1% per month.) Reduce Income Tax by a significant amount to keep the peasants at bay.

- Make doing business easier. Reduce the compliance burden on business.

- Ease off restrictive employment practices. In a buoyant economy, the businesses will care for their employees so that they don’t loose them in a market where there is more work than prospective employees.

- Reduce taxes that occur when money moves such as Income Tax, Payroll Tax, and Sales Tax and it variants.

- Immediately get rid of Payroll Tax. It is the worst of all taxes. It allows the well off to pay less tax on unearned income.

- Implement Land Tax.

- Implement Wealth Tax whilst reducing Income Tax. The well-off will hate this. 0.1% per annum is a lowly $1 in $1000. A millionaire would pay $1000 Wealth Tax. At 0.3%, he would pay $3000pa.

- The government should create the money of the nation. This should be in the form of numbered paper notes and their digital equivalent – numbered digital notes.

- Eliminate Sales Tax except for any item that is damaging to health or environment.

- Recognize that $85000 of Money Supply for each person is excessive. This means that the average bank account is reading $85000A

We need banking separation (Glass-Steagall) for the following reasons:

To stop risky investments that helped create the 2008 crash.

To protect the all-important payments system. When investment banks collapse, we do not want them to bring down the commercial banks.

To redirect the investment into the real economy where it benefits society most.

To limit the volume of speculation with its bubble and crash creating tendencies.

To return money to where it does the task for which it was invented: enable transactions and trade. Money was not invented for the purpose of giving more money to people with more-money-than-they-can-spend.

I now bring in two more levels of complexity for those that wish to be economically literate.

The aim of monetary policy is to maintain an adequate level of economic activity and to avoid inflation. The common but crude measurement of economic activity is the GDP. I say “crude” because it includes more bullets for the police and batons for the prison wardens but also because it measures the dollar value of bread sold rather than the number of loaves and their quality. There is little point in putting more money into the system or increasing the velocity of money if this volume of money only buys the same number of loaves. Thus it is the real volume of product that needs to rise. So, it is inappropriate to increase the volume or velocity of money if the production of goods and services is not able or willing to expand to match. Laws for employment must be slackened to encourage employment. If there are more jobs than workers, then bad employers will have to lift their game. To push money into an economy where the supply is inflexible will cause inflation. Also to consider is the selective nature by which banks lend. To decrease the interest rates in the hope that borrowing will increase must also consider to where this money is lent. If the lending is into a saturated housing market, the house prices will inflate as will rent leaving less for household consumption. If lending is for share purchase, shares will inflate, but bread sales will stay stagnant. If business lending is increased, businesses will invest in more efficient equipment bolstering equipment manufacture whilst increasing bread production at a reduced loaf price. Under the Basil Three agreements, the banking megalomaniacs were demanding that banks increase restrictions on lending for business for ‘protection’ of their position. This is the opposite of what society needs.

A second complexity is a study of the composition of the Money Supply. How much of this vital medium of exchange is hoarded? I developed a procedure in my book: “Hoarded Money. The Economics of Velocity”. Only available on Kindle. I declared that any money held for more than one month be deemed: ‘Hoarded’. At a velocity of twelve, no money is hoarded. At a velocity of six, 50% is hoarded, whilst 50% is considered as ‘Circulating Money’. At a velocity of three, 75% is Hoarded Money and 25% is Circulating. At a Velocity of one, 8% is circulating within one month and 92% is deemed ‘Hoarded’. Although the ‘one month’ was arbitrary, it allows an insight into the mechanics of the situation. It helps to comprehend some strange characteristics. In Canada, the Money Supply fell by about one percent. But the GDP fell by close to ten percent. The main area that money is removed from circulation is by taxation and that is entirely biased to moving money. Tax is taken when money moves – not when it hibernates. Thus the one percent reduction in the Money Supply was taken from the 8% of Circulating Money. Thus a fall in GDP of ten percent. The corollary of this is that when money is put back into the system – to where is it injected. Is it injected into the ‘Real Economy’ of loaf production or does it go to the bank accounts of the wealthy. Tis was why Quantitative Easing failed in America but worked in Australia. U.S. Quantitative Easing involve bonds. Thus money fell into the hands of wealthy organizations that operate in the financial economy of greed – making money from money – not in the land of loaf production. In Australia, Quantitative Easing involved sending $1000 cheques to citizens who promptly spent it into the Real Economy which included bread production. In some ways it was a refund or reduction on Income Tax which bolstered the Real Economy without causing inflation as there was productive capacity to cope. The Australian government also authorized numerous immediate local infrastructure projects such as building covered areas for schools. This made money move in the local rejionzzz.

One interesting issue from the ‘Circulating Money’ calculation is to consider the cost of the provision of a Money Supply. If interest rates are 10%, Australia’s Money Supply of $2000B (billion) would cost $200B per annum. If Australia has a velocity of one, only 8% of the $2000B is moving within one month which is $160B. So it costs $200B per annum to have an effective Money Supply of $200B. However, that is not the main message of this article.

Quite simply:

- The assumption that the monetary policy should control the magnitude of the Money Supply alone is nonsense.

- The assumption that the magnitude of the Money Supply should be controlled by interest rates is nonsense. Government spending is a better tool as is a reduction in Income Tax or Sales Tax.

- The assumption that the central banks should be: “Free from political interference” is nonsensical.

- To increase a healthy GDP, Money Supply or Velocity can be increased.

- Money was created to enable transactions. It was not invented to be hoarded. Hoarding destroys economies and makes a country prone to hyperinflation.

- Currently, most taxes are taken from transactions which is when money is acting as money. This needs to be biased towards static items and all tax on transactions should be reduced or eliminated.

- Payroll Tax is possibly the worst of all taxes. It must be eliminated. It allows unearned income to get a preferential tax treatment.

- Items bought for gain by appreciation should be revalued annually and taxed as unearned income. (‘Negative Gearing’ should not be a tax lurk!)

Andy Chalkley. North Perth, Western Australia

andy@chalkley.au

This Solution is not copyrighted.

[1] RBA 2018-08

[2] Australian Debt Clock

[3] www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1.pdf

[4] Nobel Prize-winning economist Angus Deaton

[5] Bank of England. Quarterly Bulletin 2014 Q1. Money creation in the modern economy.

[6] [Hansard 1947 Australia, House of Representatives, Debates, 6 November 1947, viewed 6 July 2017, http://historichansard.net/hofreps/1947/19471106_reps_18_194/